$27 Billion for Climate Equity

The Greenhouse Gas Reduction Fund (GGRF) is the single largest bucket of money from the $369B in climate funding from the Inflation Reduction Act (IRA). The GGRF will mobilize financing and private capital for climate projects to reduce pollution and greenhouse gas emissions.

By leveraging innovative green bank financing, $20 billion of the GGRF will maximize every public dollar to generate more than $250 billion in combined public and private investment over the next decade. The best part is - at least 40% of these investments will serve disadvantaged communities. By 2033, communities most impacted by climate change will benefit from more than $67 billion in climate investments that meet their unique needs.

Through 3 unique programs, the GGRF will help impacted communities overcome financial barriers, address environmental problems, and create hundreds of thousands of green jobs:

National Clean Investment Fund

$14 billion to create national green bank network and increase access to financing for clean projects.

Clean Communities Investment Accelerator

$6 billion to build capacity for local community lenders working in disadvantaged communities.

Solar for All

$7 billion to states, cities, tribes, and communities to deploy solar in low-income and disadvantaged neighborhoods.

We're engaging communities to advance climate equity and economic justice.

Our vision for the GGRF National Clean Investment Fund is for disadvantaged communities to be able to access the financing they need and deserve to deploy green technologies. Our four engagement strategies center communities throughout the process – from education to implementation – to ensure no one is left behind in the green transition.

Knowledge Building

Project Identification

Workforce Development

Market Transformation

We're working to make sure disadvantaged communities are first in line to benefit.

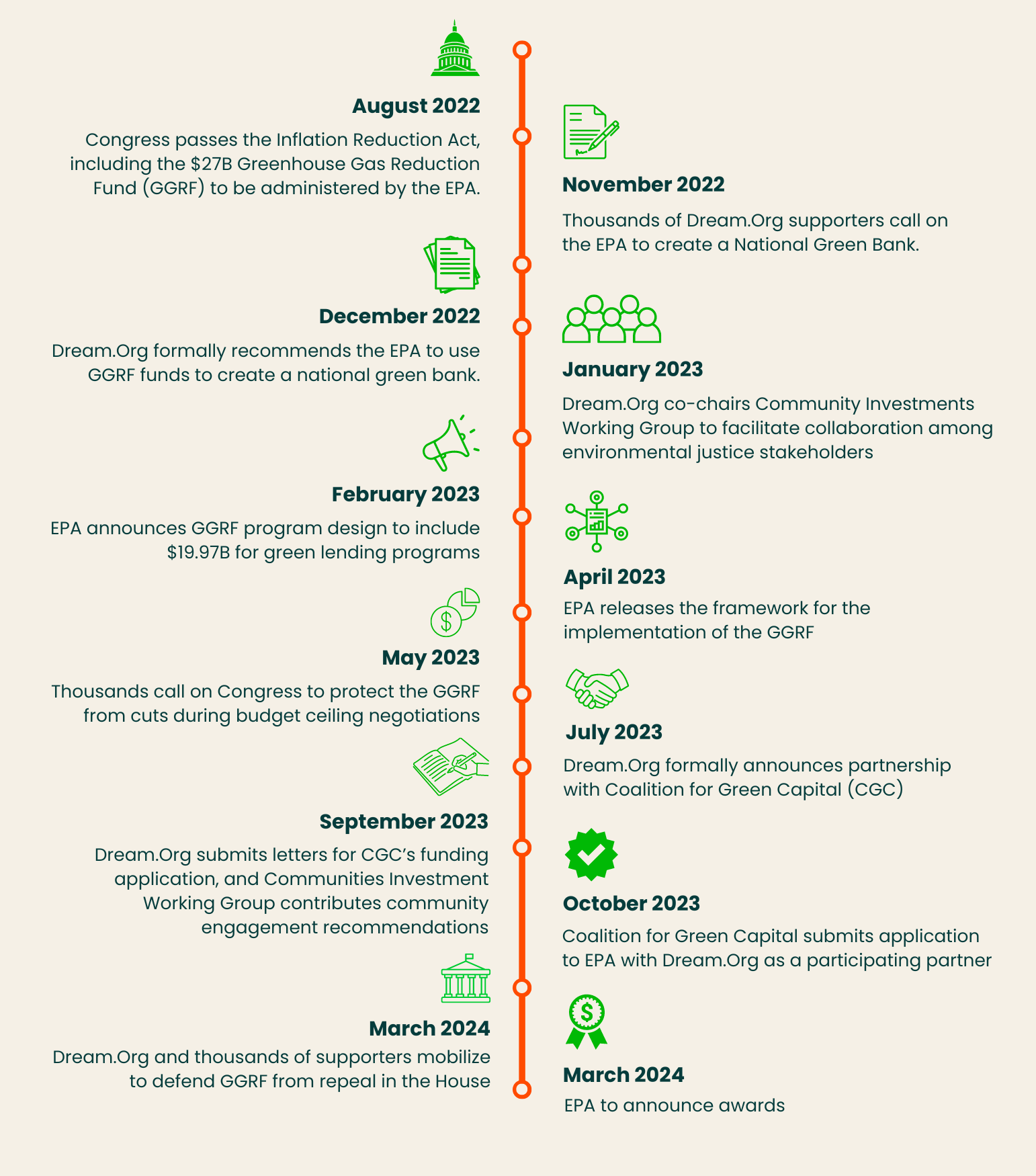

Since the passage of the Inflation Reduction Act in 2022, we have worked together with our supporters and partners to advocate for equitable programs that uplift communities most impacted by poverty and pollution. We believe using these funds to create a national green bank network will have a historic impact on our communities, our environment, and our economy.

Dream.Org’s Climate Investments team has worked to build bridges among partners, launch community engagement initiatives, and increase awareness about the benefits of green banks for disadvantaged communities. We've mobilized tens of thousands of Americans to voice their support for the GGRF, and the EPA integrated all of our policy recommendations into the structure of the program.

Dream.Org is a proud participating partner on the Coalition for Green Capital's (CGC) National Clean Investment Fund proposal. Working together with climate justice stakeholders, Dream.Org co-chaired the Community Investments Working Group and played a key role in incorporating Justice40 principles throughout the proposal.

Dream.Org is working to educate and mobilize communities, lawmakers, and supporters like you so we can achieve historic wins for climate equity – together.

What is a green bank?

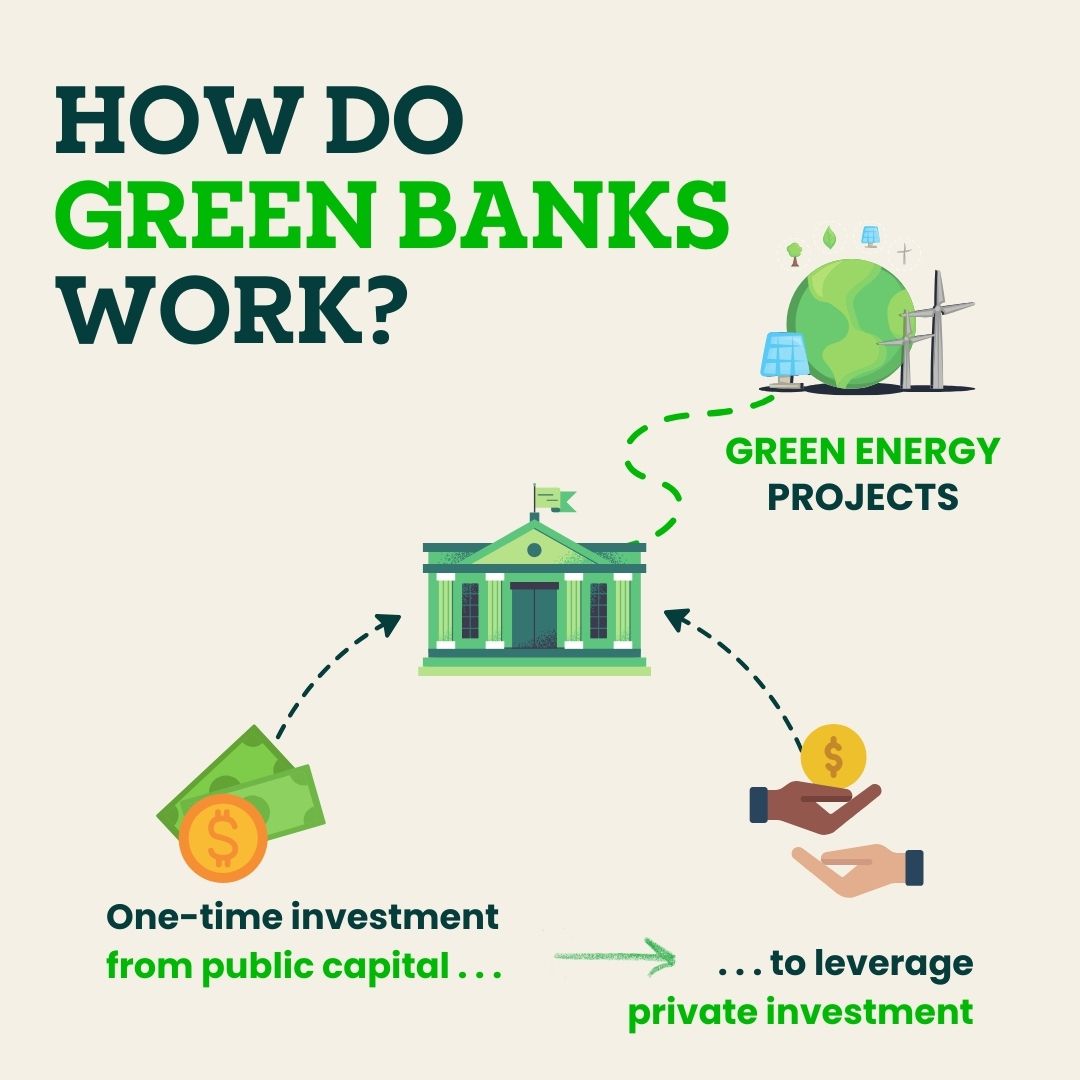

Green banks are mission-driven public finance institutions that use traditional financial tools such as leverage, underwriting, and credit enhancement to fill financial gaps, remove market barriers, and incentivize the private sector to invest in clean energy projects.

For low-income and disadvantaged communities who may not be eligible for financing from a traditional bank, green banks are a game changer. Increasing access to green financing can alleviate the disproportionate health impacts these communities suffer while creating lucrative jobs and reducing energy costs.

Over 30 state and local green banks across the country are using public investment to mobilize private capital, transforming communities and spurring economic growth. The GGRF provides an unprecedented opportunity to take the green bank model to a national scale, unlocking access to climate solutions for communities that have historically been left out and left behind.

Green banks fill in the gaps.

After COVID-related supply chain disturbances and years-long drought, Ute Mountain Ute Farm & Ranch Enterprise needed help retrofitting their irrigation system to be more effective and economical. But tribal communities often struggle to access traditional financing and capital.

That's where the Colorado Clean Energy Fund came in. They financed an irrigation project using micro-hydro technology to produce renewable energy while substantially reducing operation costs.